Amid all the talk about the increasingly challenging antitrust environment, what do the numbers actually tell us about the chances of successfully closing a complex global deal and how long this is likely to take?

Looking across the US, EU and UK over the last four years (i.e. since Brexit came into effect in 2020), the statistics reflect an increasingly challenging dealmaking environment for complex global deals:

- More than 40% of complex global deals did not close, and the vast majority (75%) of the deals that did close required some form of remedy to secure antitrust approvals.

- Complex global deals are on average taking longer to close, with parties in 2023 requiring around 18 months to secure antitrust approvals when engaged in in-depth multi-jurisdictional reviews.

- Complex global deals in the tech sector have proven most likely to face in-depth review, and were most prone to abandonment by the parties.

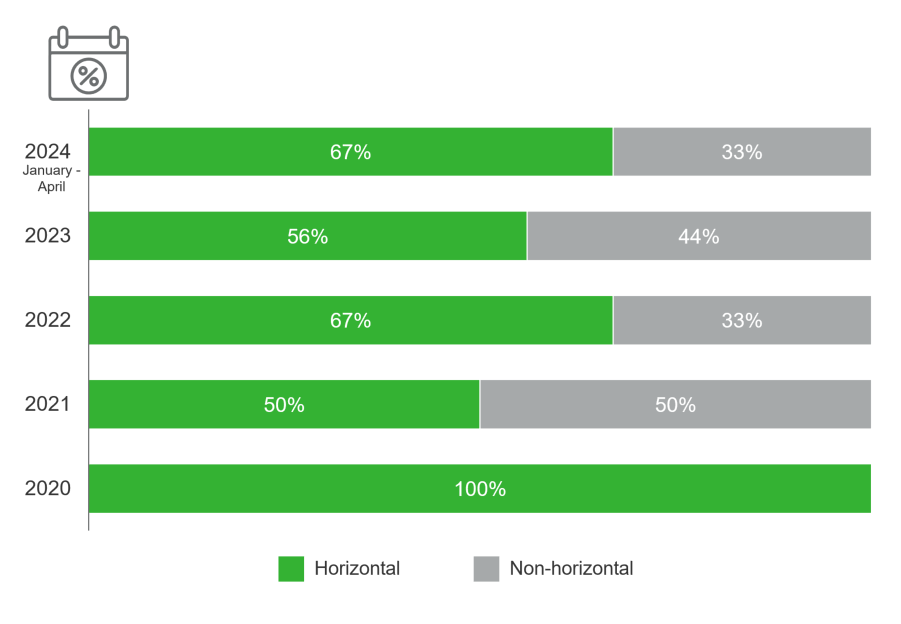

- Our analysis also confirms a rise in non-“traditional” concerns relating to complex global mergers, with non-horizontal theories of competitive harm (i.e. at different levels of the value chain) featuring in approximately one third of all cases. The data supports the view that regulators are increasingly willing to pursue a novel and expansive approach to merger enforcement.

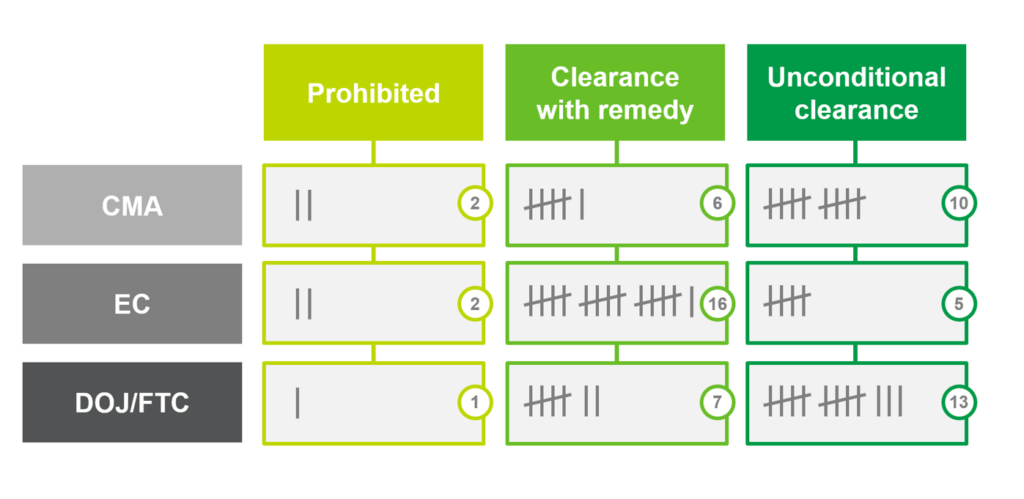

- The data also shows that while the FTC/DOJ and CMA have been more likely to get comfortable clearing difficult deals unconditionally, the EC has shown its preference for requiring a remedy. Our review also confirms that the US/EU/UK regulators have all shown a willingness to prohibit transactions, and not necessarily in relation to the same deal. This adds further uncertainty and complexity to the regulatory landscape for complex global M&A.

Methodology: Identifying “complex global deals”

We have identified as a “complex global deal” a transaction that: (i) has been referred for a second request or an in-depth phase 2 review in at least one of the US, EU or UK (i.e., because it is considered to potentially raise substantial antitrust concerns); and (ii) is also subject to parallel review (at either phase 1 or phase 2) in at least one of the remaining two jurisdictions.

We have analyzed deals that were announced as either closed or abandoned between January 1, 2020 (i.e. the month of the UK’s exit from the EU) and April 30, 2024. Our findings are based on publicly available statistics and data from the relevant merging parties and agencies where available.

We note that deals captured by our dataset are not an everyday occurrence and reflect only a small subset of notifiable deals each year. Indeed, there have been only 35 complex global deals (meeting our criteria) in total since January 1, 2020.

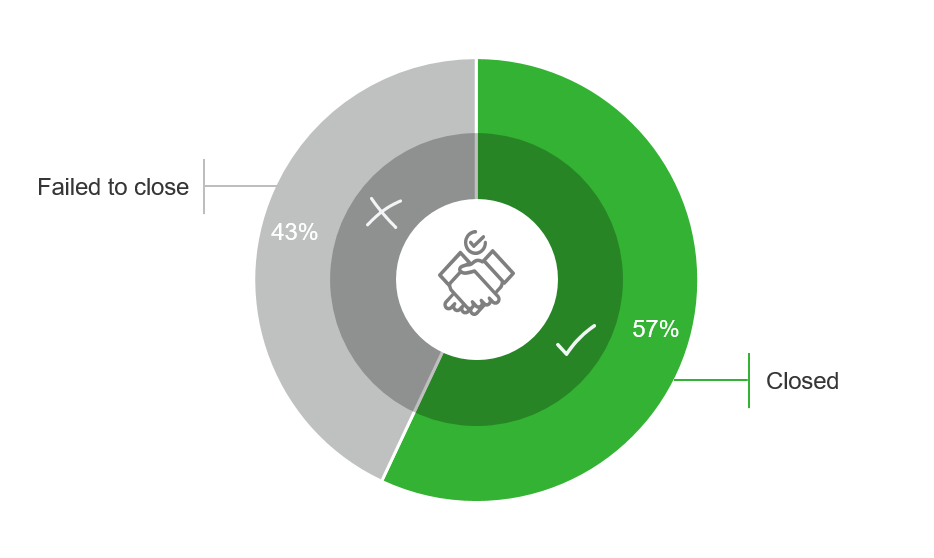

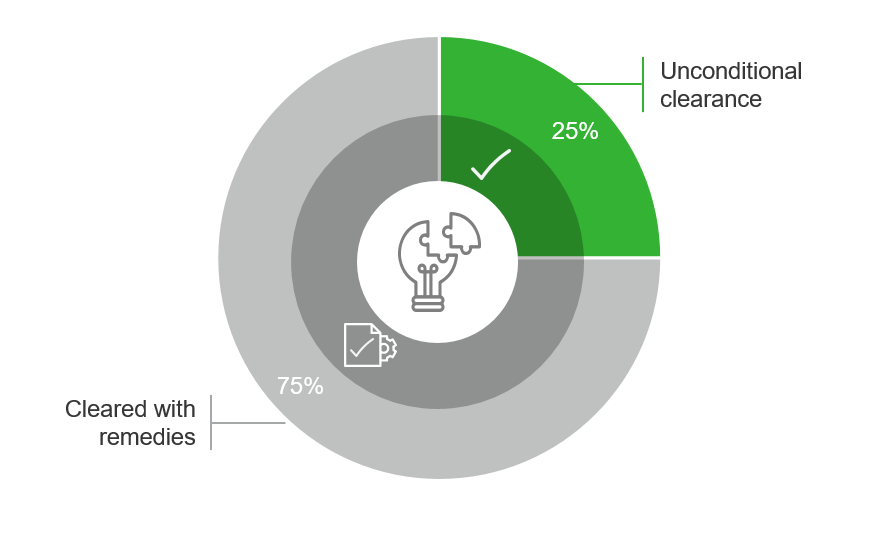

The headline: More than 40% of complex global deals do not close and the vast majority (75%) of deals that closed required some form of remedy

Since 2020, 43% of complex global deals were abandoned (following a prohibition decision or otherwise), compared with 57% of deals which successfully closed.

Meanwhile, of the 20 complex global deals which did close, 15 deals (75%) required some sort of remedy, whether structural or behavioral. This underscores the importance of a tailored strategy that accommodates credible remedies proposals capable of convincing regulators across a number of jurisdictions (see drill down #4). This is particularly the case given that remedies processes are becoming increasingly as thorough as the substance of merger reviews.

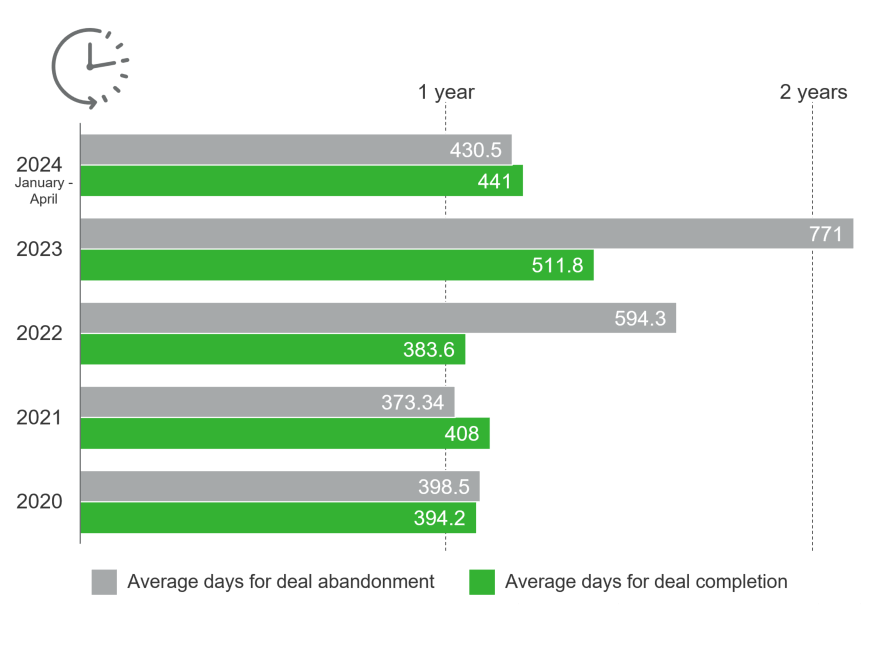

Drill down #1: Complex global deals are taking longer to close (and to be abandoned)

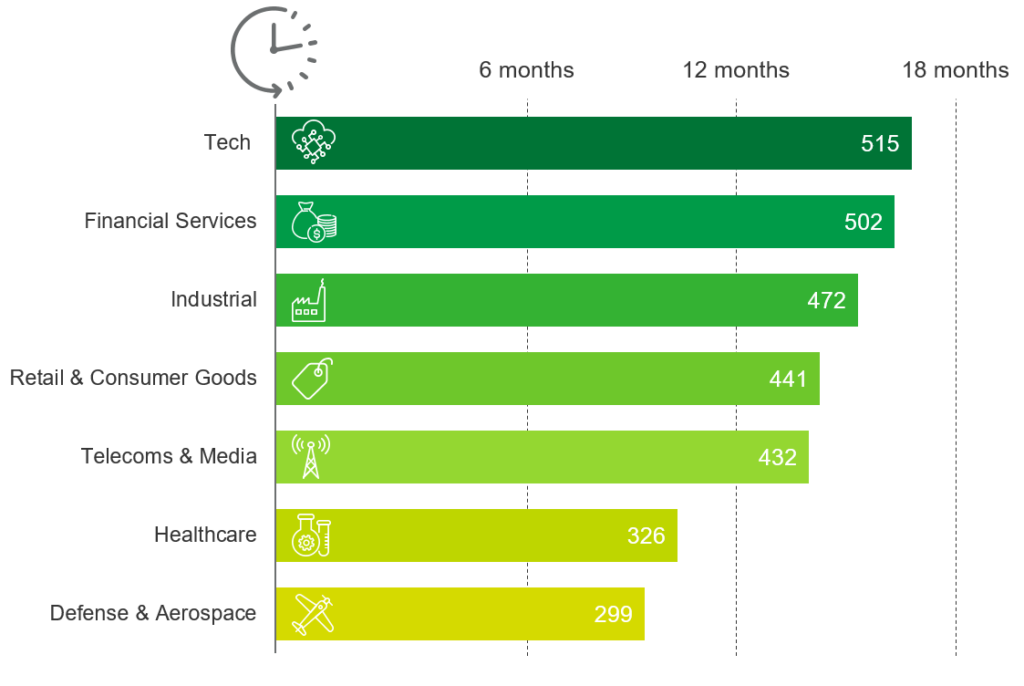

As compared with recent years, 2023 saw a significant increase in the average time between signing and closing, from 383.6 days in 2022 to 511.8 days in 2023. In practice, this means that (depending on the sector – see drill down #2 below) an extensive transaction timetable of at least 18 months for complex global deals would not be unheard of to allow sufficient time to secure antitrust approvals. Time horizons can be further complicated by factors such as jurisdictional challenges (see, e.g., Qualcomm/Autotalks, where the deal was referred to the EC under Article 22 EUMR and ultimately abandoned in March 2024 due to “the lack of timely approvals”).

2023 also saw a dramatic increase in the average duration of regulatory review before merging parties decided to abandon their transactions (594.3 days in 2022 to 771 days in 2023). This spike reflects the Illumina/Grail deal, which was somewhat of an outlier in that it was the first transaction subject to an EU referral under the European Commission’s recalibrated policy to call in certain below-threshold deals. Illumina confirmed that it would divest Grail (i.e., unwind the transaction) on December 17, 2023 – 1183 days following the original deal announcement.

The first four months of 2024 show a slight decrease in the time needed to complete a transaction, although whether this trend continues for the rest of 2024 remains to be seen. In any event, we expect it to stay well above 12 months.

Drill down #2: Tech and healthcare sectors face most scrutiny

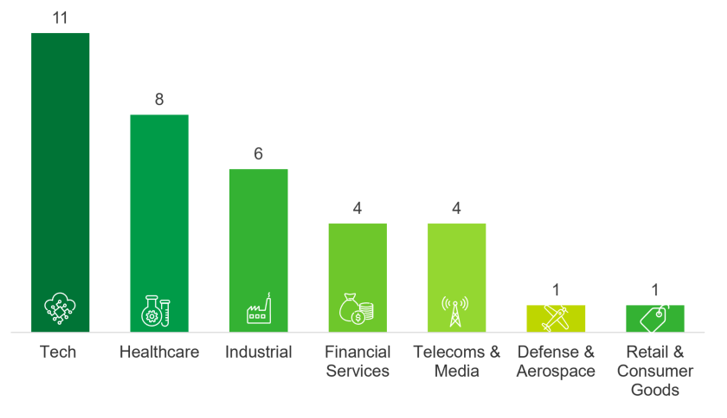

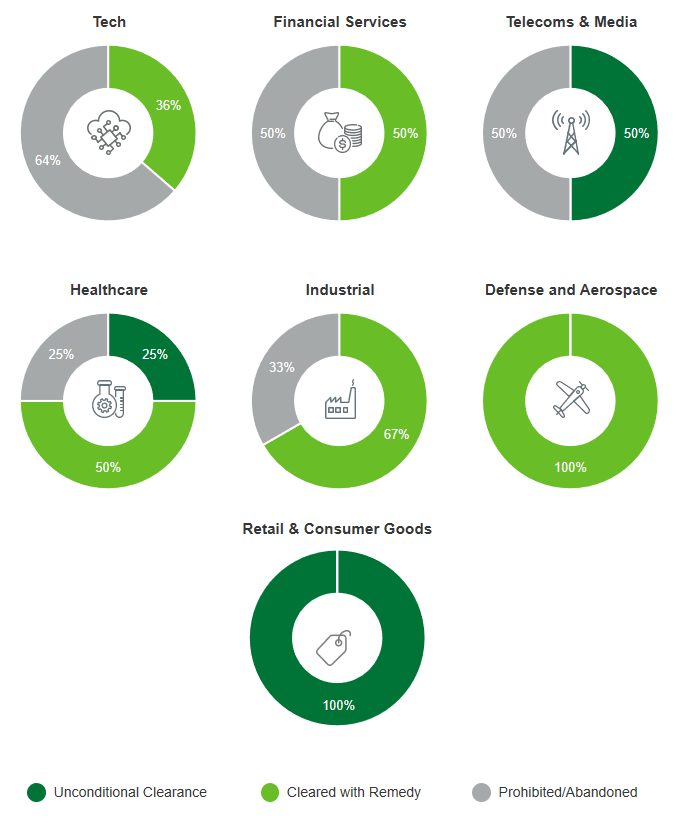

Sectors that have most often come under scrutiny are – perhaps unsurprisingly – tech (11 deals), healthcare (8 deals), and industrial (6 deals). Next comes financial services and telecoms & media (4 deals), and finally defense & aerospace and retail & consumer goods (1 deal).

In terms of outcomes, predictably the tech sector saw deals that were most likely to face prohibition and/or abandonment (Adobe/Figma, Booking/eTraveli, Nvidia/Arm, Sabre/Farelogix, Taboola/Outbrain, Qualcomm/Autotalks, Amazon/iRobot). This was perhaps driven in part by the fact that suitable remedies to address novel theories of harm (see drill down #3 below) have been more difficult to implement. Meanwhile, our data shows that unconditional clearances have been most prevalent in the telecoms & media (Viasat/Inmarsat, Amazon/MGM) and retail & consumer (Arcelik/Whirlpool EMEA) sectors.

On average, deals in the tech space are also taking the longest time to close (515 days), followed closely by financial services (502 days). Defense & aerospace deals are taking the least time to close (299 days).

Drill down #3: Non-traditional ways of challenging deals are on the rise

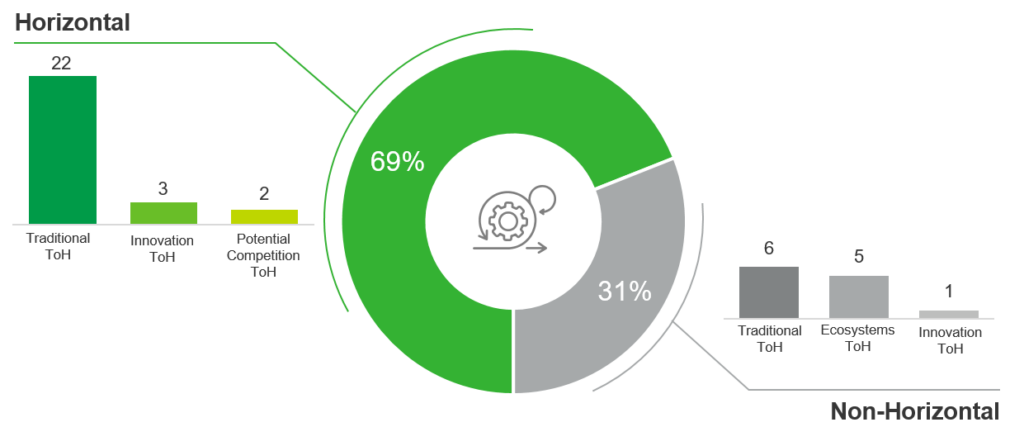

The data shows us that while more “traditional” concerns about horizontal deals (i.e., occurring at the same level of the value chain) have continued to dominate reviews of complex global deals, non-horizontal theories of harm have increasingly played a significant role – featuring in 31% of cases. This reinforces the increasing need to plan for regulators pursuing novel and innovative theories of harm.

The data confirms that novel challenges are more likely to feature in non-horizontal deals, in particular with vertical theories of harm and early articulations of a theory involving “ecosystems” featuring in these cases. These were seen early on in our data set in cases such as Google/Fitbit and Amazon/MGM, and become more established in more recent cases such as Broadcom/VMware, Microsoft/Activision, Booking/eTraveli, and Amazon/iRobot.

This pursuit of novel theories of harm reflects a macro trend for complex global deals of non-horizontal mergers attracting greater scrutiny. This has sharply increased over the last several years, starting with a watershed even split of horizontal and non-horizontal reviews in 2021 (50%), with non-horizontal reviews continuing to represent a significant proportion of cases in each of 2022 (33%) and 2023 (44%), and in the first four months of 2024 (33%).

Against this backdrop, regulators are also finding novel ways to challenge horizontal mergers. Non-“traditional” theories of harm relating to a merger’s effect on potential competition (Adobe/Figma, Sabre/Farelogix) and/or innovation competition (Qualcomm/Autotalks, Pfizer/Seagen, Sika/MBCC) have increasingly played a pivotal role in the substantive analysis.

Drill down #4: Avoiding divergent outcomes will require a persuasive global strategy

The data for complex global deals also confirms that there is scope for divergence in outcomes between regulators, making the landscape for merger approvals even more uncertain and complex. While the FTC/DOJ and CMA have been more likely to get comfortable clearing difficult deals without requiring a fix to address their potential concerns, the EC has shown a strong preference for remedies.

Notably, approximately 70% of complex global deals which were not abandoned by the parties have required some form of remedy in order to secure EC approval (vs. approximately 33% for both US and UK agencies). In the US, these do not include deals in which the parties undertook commitments prior to a formal complaint from the FTC/DOJ. As these statistics do not capture whether intervention by one or more regulators ultimately led parties to abandon their transactions over this period, this only reinforces the need for a global strategy.

This is further supported by the fact that the US/EU/UK regulators have all shown a willingness to prohibit transactions. Moreover, although our data counts only one ultimate US court block (Penguin Random House/Simon & Schuster in 2022), the FTC and DOJ have been increasingly willing to litigate against transactions, leading to abandonment (e.g., Visa/Plaid). Simply put, the data shows that scrutiny of a complex global deal can come from any direction.

That said, while remedies are increasingly complex, it is still possible to get the regulators comfortable with large global transactions. This was shown in cases such as Microsoft/Activision and Broadcom/VMware. A robust and persuasive global strategy which factors in the differences in markets/market dynamics, as well as the attitude of different regulators, will be critical. Merging parties are generally encouraged to begin constructive discussions on remedies early in the process – as most recently codified by the CMA’s refreshed phase 2 procedural guidance.