Last year, we published statistics showing an increasingly difficult environment for complex global deals, reflecting enforcement activity in the US, EU and UK. Our 2025 update shows that the past 12 months have seen something of a let up in the regulatory environment for such deals, with no prohibitions and only one abandonment.

However, with only six deals falling in our definition of a “complex global deal” in this period and with significant recent political changes across jurisdictions, it remains to be seen whether this is representative of a broader trend. Indeed, of the six deals analyzed, three were first announced between 2020-2022 and may therefore not fully reflect the enforcement environment today.

Below we set out what we can learn from the complex global deals in the past 12 months, and what to look out for in the coming months as dealmakers evaluate opportunities in a changing geopolitical environment.

Methodology: Identifying “complex global deals”

Like last year, we have identified as a “complex global deal” a transaction that: (i) has been referred for a second request or an in-depth phase 2 review in at least one of the US, EU or UK (i.e., because it is considered to potentially raise substantial antitrust concerns); and (ii) is also subject to parallel review (at either phase 1 or phase 2) in at least one of the remaining two jurisdictions.

We have analyzed deals that were announced as either closed or abandoned between May 1, 2024 and April 30, 2025. Our findings are based on publicly available statistics and data from the relevant merging parties and agencies where available.

We note that deals captured by our dataset are not an everyday occurrence and reflect only a small subset of notifiable deals each year. Indeed, there have been only 41 complex global deals meeting our criteria since January 1, 2020.

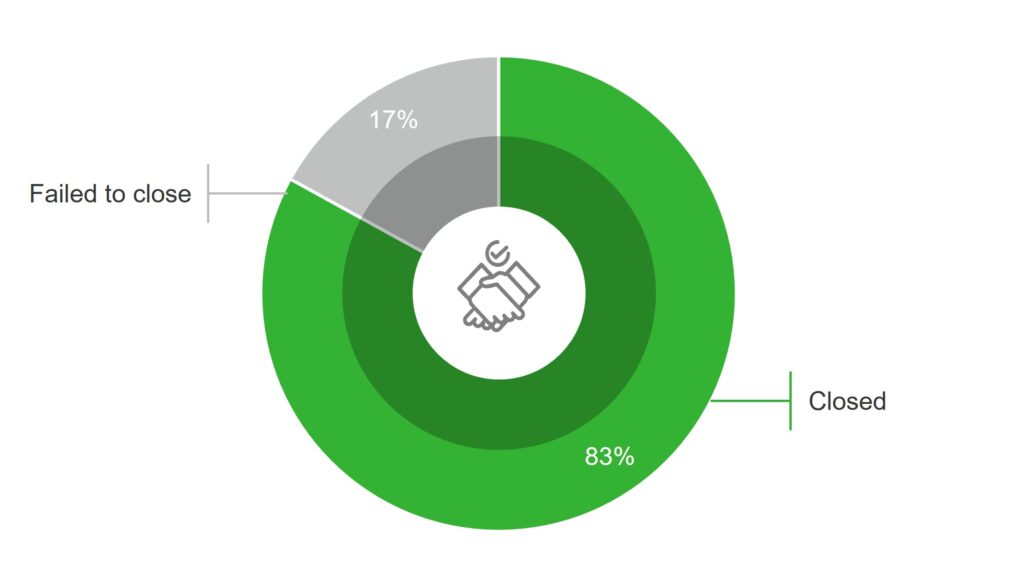

The headline: Over 80% of complex deals closed in the past 12 months

Since May 1, 2024 five out of six (83%) complex global deals secured regulatory approval and successfully closed. Only one deal (Tapestry/Capri) was abandoned, after the FTC successfully secured a preliminary injunction against the merger (which had secured unconditional clearance in the EU and Japan).

Of the five complex global deals which did close, three (60%) required a remedy – in each case a structural divestment. In two cases, a remedy was required in both the EU and UK while in the other only the CMA required a remedy. The FTC/DOJ did not enter into any formal consent decrees for complex global mergers in the past 12 months, reflecting a broader scepticism of merger settlements under the Biden administration.

Significantly, the two complex global deals which secured unconditional clearance were the only two which featured non-horizontal theories of harm – Novo/Catalent and IBM/Hashicorp. This incidence of non-horizontal theories (i.e., 33%) remains broadly consistent with our previous findings (featuring in 31% of cases between 2020-2024), showing that such non-horizontal mergers will continue to attract scrutiny. However, dealmakers may find some solace in the fact that both deals closed.

Closing delay continues to be a constant feature for complex global deals, in particular where remedies are required

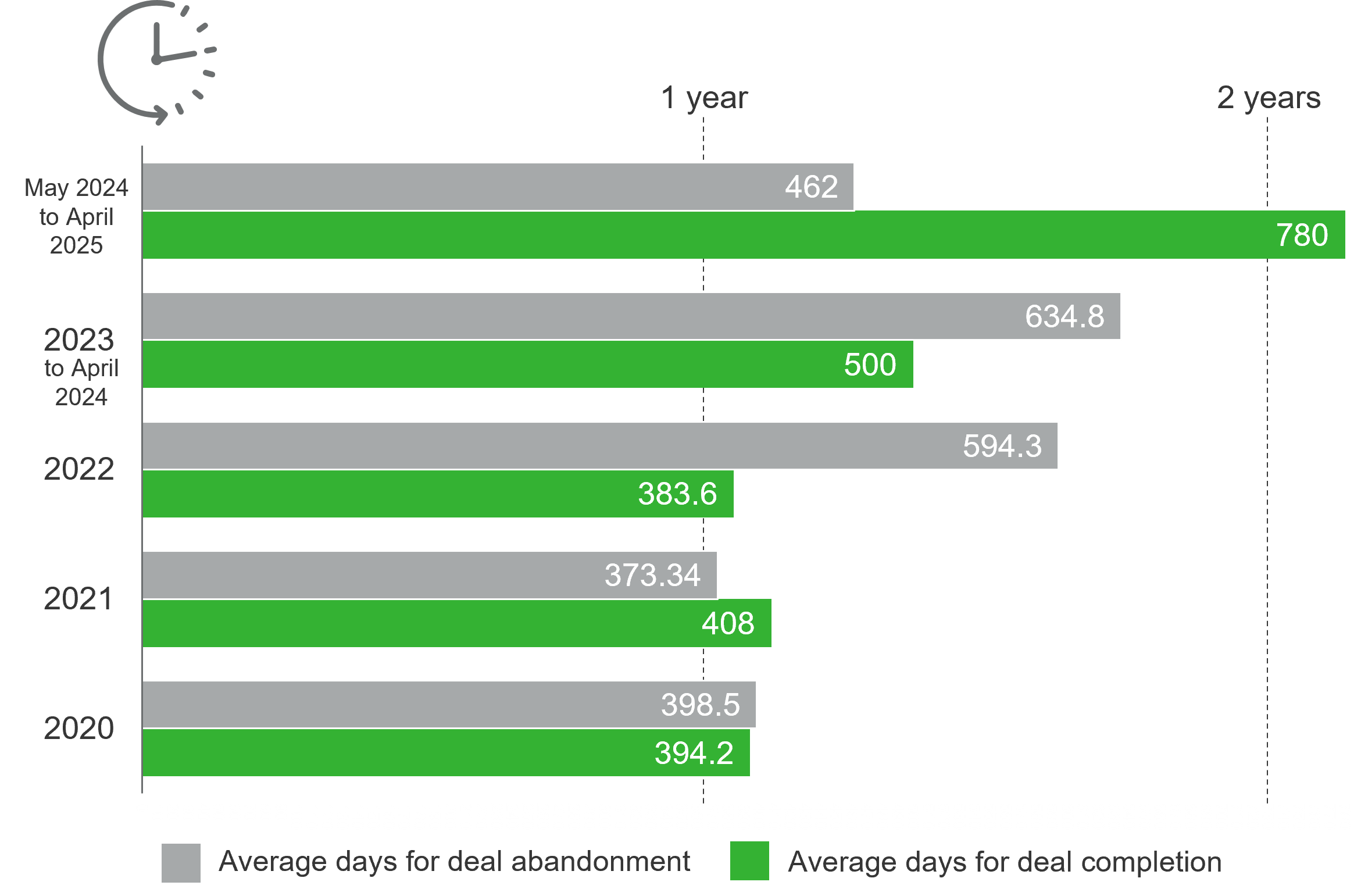

As compared with recent years, the last 12 months saw a significant increase in the average time between signing and closing. The five deals which closed took on average 780 days to do so, compared to approximately 500 days in 2023.

This number was skewed by the Korean Air Lines/Asiana Airlines case, which took over four years from deal announcement to finally close in December 2024. Nevertheless, there is a need to build significant time into the transaction timetable to secure antitrust approvals for complex deals, in particular where remedies need to be negotiated. Notably, even the two deals which secured unconditional approval without needing to face an in-depth Phase 2 investigation in either the EU or UK still required over 10 months to reach closing.

Average length (days) announcement to completion 2020-2025

The only complex global deal to be abandoned (Tapestry / Capri) did so 462 days after signing, broadly consistent with the deals merging parties decided to abandon in 2020-April 2024.

Looking ahead: do complex global deals face continued headwinds?

The above picture may suggest that, while complex global deals continue to face significant (and lengthy) scrutiny from antitrust agencies, the path to closing has eased slightly compared to recent years. However, with only six cases falling within our definition in the past 12 months, caution must be exercised in interpreting these findings. For example, none of the cases faced in-depth scrutiny in all three of the US, EU and UK, while three of the cases were first announced between 2020-2022, falling within our dataset because they closed in the past 12 months (even though antitrust reviews were completed in 2023 or early 2024). They may not therefore be fully representative of the current enforcement environment, and it remains to be seen whether the reduction in the proportion of prohibitions/abandonments for complex global mergers observed last year will continue.

This is even more so given the significant changes in political leadership seen on both sides of the Atlantic in recent months, which may impact enforcement against mergers going forwards.

- In the US, there has been change of leadership at the FTC and DOJ under the new Trump administration, as well as the removal of the two Democrat FTC Commissioners and appointment of a third Republican FTC Commissioner. Importantly, the new head of the DOJ, Gail Slater, has expressed a greater willingness to consider remedies—particularly divestitures—compared to the prior administration, potentially providing dealmakers with an easier path to clearance. However, the DOJ’s challenge to HPE/Juniper and Global Business/CWT (which fall outside our stats above since they are yet to either close or abandon) suggests caution is warranted (see our previous post).

- The impact of the new EU Competition Commissioner, Teresa Ribera, on the EC’s assessment of mergers remains to be seen, although she has indicated a shift in policy towards supporting ‘European’ champions so that EU companies remain competitive “in global markets”. With an extensive review of the EC’s merger guidelines in the early stages, the EC is expected to signal a greater willingness to clear mergers on the basis of wider market benefits, including increased innovation, in future. On the flip side, however, and against the backdrop of the European Court of Justice’s landmark decision in Illumina/Grail, the EC’s focus on preventing “killer acquisitions” remains intact, as explored in our previous post.

- In the UK, following a strategic steer from the government to increase business confidence and support growth in the UK, the CMA has initiated an overhaul of its mergers regime, promising faster merger reviews, a revised approach to remedies and a more restrained approach to global mergers (see our previous post). These shifts can already be seen reflected in recent cases, with the CMA deviating from its previously articulated preference for structural remedies in cases such as Vodafone / Three UK and unconditionally clearing both deals reviewed under its revised Phase 2 process to date.

Given the uncertainty, what should dealmakers do? The answer is simple – be prepared. Regardless of the geopolitical environment, complex global mergers will continue to attract close antitrust scrutiny. However, with regulators across the major jurisdictions reconsidering their processes, substantive assessment and approach to potential remedies, the landscape for merger approvals is perhaps even more uncertain and complex than ever. As such, businesses should ensure that their deal planning is robust, putting in place a comprehensive strategy in place from the outset to coordinate varying timelines, address global and local issues and plan in advance for workable remedies, where likely to be needed.

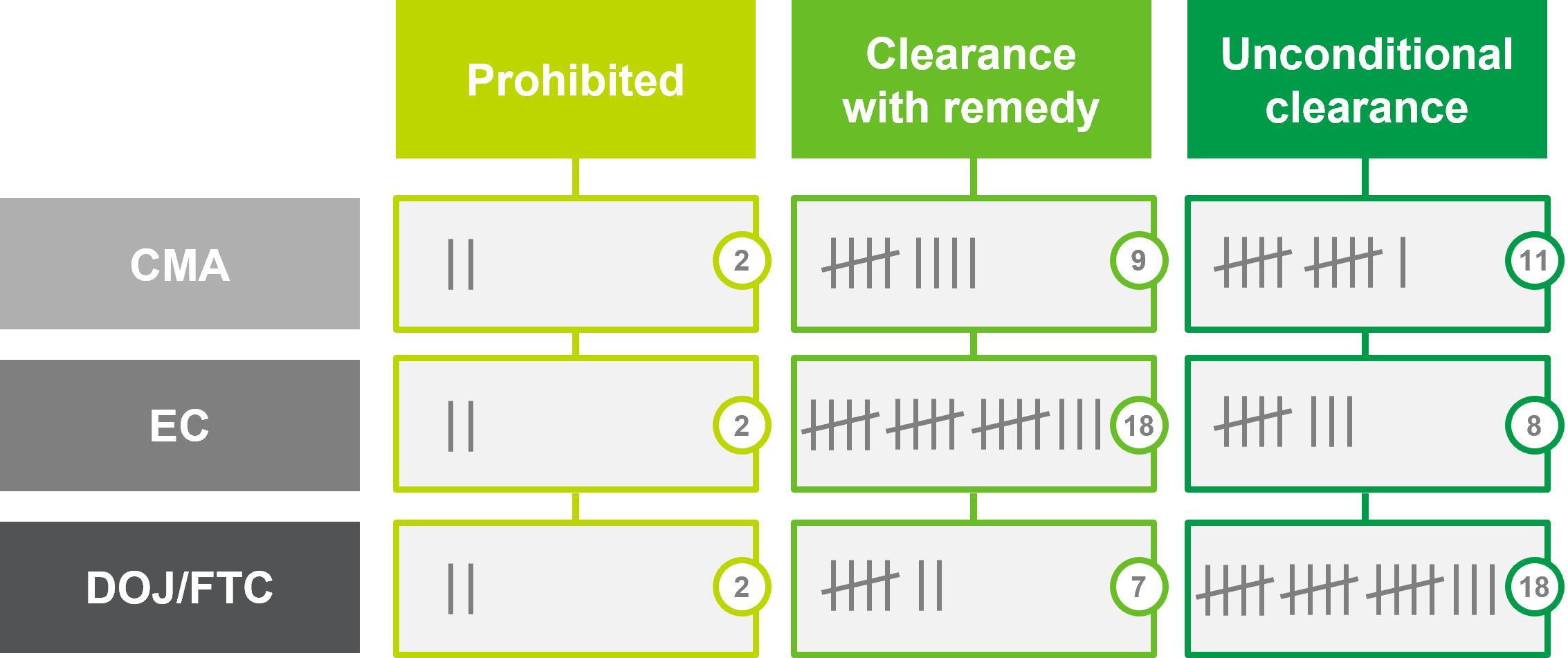

Complex global mergers – US/EU/UK outcomes 2020-2025